In this episode of the EUVC podcast, Andreas discusses, with Richard Muirhead, Managing Partner at Fabric Ventures, the transformative potential of Web3 and AI.

Richard shares insights into how these technologies will reshape the internet, the power dynamics between big tech and decentralized communities, and Fabric Ventures' role in this evolving landscape. We also discuss ethical considerations, the development of decentralized finance, and the challenges and opportunities facing venture capital in Europe.

Fabric Ventures is a 125M EUR fund, with 250M under management, anchored in Europe around Paris & Zurich, but investing globally. They are actively investing in WEB3, which has become a global phenomenon, and they have incredible investments in their portfolio so far, such as Sorare, Ramp, Near, Immutable, Polkadot, Flashbots, and many more.

Watch it here or add it to your episodes on Apple or Spotify 🎧

This episode is brought to you in partnership with Zero One Hundred Conferences, which organizes LP-GP networking events for PE & VC players in various European regions with a global outreach. In the last 8 years, they have hosted 50 events with 1700+ speakers, 6500+ investors, and 12000+ attendees.

The upcoming 0100 Conference Mediterranean presents a unique opportunity for private equity and venture capital LPs and GPs to meet and develop meaningful relationships.

Attendees will include major industry firms such as the European Investment Fund (EIF), Tikehau Capital, Vencap, Arcano Partners, Amundi-Alpha Associates, P101, United Ventures, Merseyside Pension Fund, and many more.

Chapters:

02:30 Richard’s Journey into Venture Capital

07:20 The Evolution of the Internet: Web1 to Web3

09:20 The Role of Blockchain and DAOs

14:35 The Intersection of AI and Web3

22:32 Challenges and Opportunities in Web3 Adoption

26:59 Disrupting Centralized Powers with Web3

29:20 The Future of AI and Web3 Integration

33:43 AI Safety and Ethical Considerations

35:28 The Case for Open Source AI

37:19 Challenges of Open AI Systems

37:59 Business Models in Open AI

40:48 Token Economics and Incentives

42:35 Decentralized Systems and Network Effects

50:35 Operational Challenges in Venture Capital

53:57 Building a Successful VC Firm

57:34 Advice for Emerging Managers

01:05:04 Concluding Thoughts on Venture Capital

✍️ Show notes

Is Web3 x AI ‘a thing’, and does it matter?

In the near future, AI will service our every need safely and with integrity…or will it? Exactly how these systems are built will determine the answer.

1/ There are FIVE key inputs:

Compute

Talent

Data

Models

Governance

For decades, AI has flourished because of the open research, development & contributions from academia, governments, and companies around these inputs. Let’s double-click on a couple of examples.

2/ Data

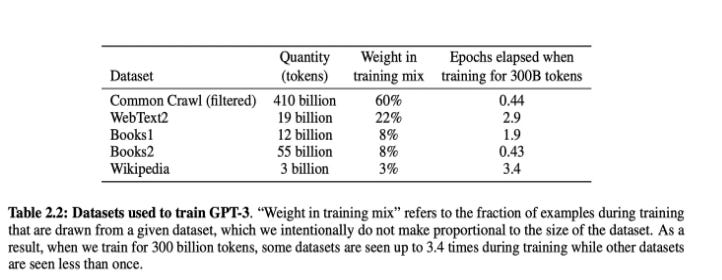

ImageNet was a clear catalyst for the deep learning boom; Current state-of-the-art models are mostly trained by scraping the open web. The dataset below was used to train GPT-3 (@jimmy_wales)

3/ Models

Building in the open has resulted in extraordinary innovation from the global community, from AlexNet (UToronto, ‘13,), alphaGo (@GoogleDeepMind), Deep mind, 2016,), Transformers paper (@Google, 2017), to GPT-1 (@OpenAI, 2018), and more recently, the Llama models (@Meta, 2024)

4/ Talent

A remote-first ecosystems - fascinating innovations such as running Llama on an iPhone using MLX, or an independent researcher writing 84 new matrix multiplication kernels for llama (https://justine.lol/matmul), making it magnitudes faster.

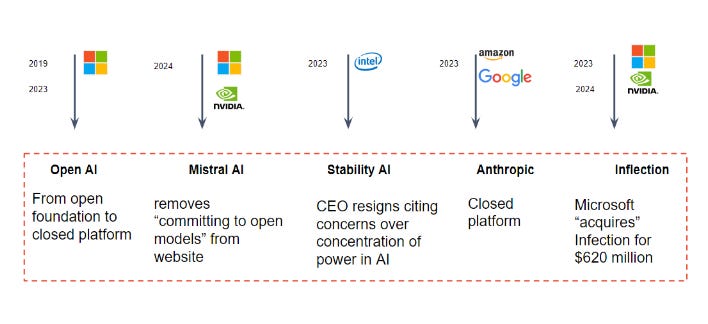

5/ A victim of their own

But now, a victim of their own success, exponentially rising compute costs have forced open startups to sell equity to the massive web2 compute providers. With new owners, they have turned away from their open origins.

6/ Governance

They argue, of course, that the move from open to closed is necessary - only they can do safety properly, and others cannot be trusted with open models - “Open Models are harder to control and put guardrails on… I’m not saying we should ban it outright but we should look carefully at their implications as they grow.”

It conveniently ties into the tech titans’ business model, controlling the means of production and selling access to the outputs. Yet the pitfalls of Web2 are already well understood.

Corruptible governance

Deliberate and Accidental Bias

Lack of Transparency & Privacy

Profit over utility

Single points of failure Hence: “don’t be evil” > “can’t be evil”.

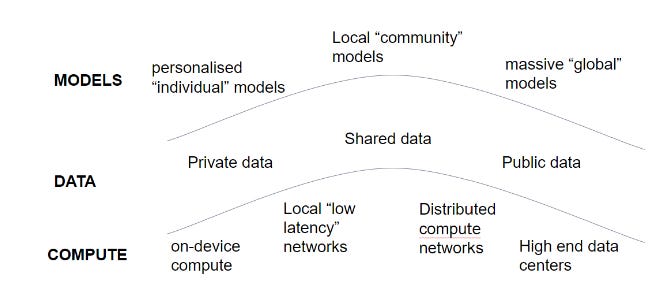

Not only is this better, it’s necessary. Today AI looks like simple chatbots, but in the future it will need to cater to increasingly complex requests ranging from geopolitical national security matters to custom models that adapt to specialised, localised computing environments.

Call to BUILD a better path. One that maintains the open, permissionless & productive innovation AND also delivers compelling & sustained economics for participants.

A ‘Can’t EVER be Evil’ architecture.

3 biggest learnings in venture

You shouldn’t look for deals or do any analysis. They should come to you and they will either feel right or not and any more time wasted is time not spent seeking the ‘next’.

Few people outside of operators have earnt the right to advise founders.

It’s about what could go right / not wrong. It’s about committing not omitting. It’s about ‘just the right side of crazy.’

Advice for young people in the industry

Go join a Series A funded company and work in product management, or even better raise seed funding for your own.

Just start ‘cutting cheques’ …however small…into projects that excite you.

Interview the founding teams and their advisors and publish this as X storms, podcasts, mirror posts or whatever.

Tips & tricks for emerging VCs

Find your team (hint: you probably already know and trust them)

Pick an ‘edge’, now more than ever you need to be distinct, and align every aspect of the firm with it.

Court your anchor. This is more about matchmaking than money-making if you have picked your edge well.

Most counterintuitive learning

For a long-term business, short term results weigh disproportionately. Especially in Europe.

Results count, but brand matters.

Top venture investors must embrace significantly more risk than the average founder…each time they place a ‘bet’.

Consensus is a cancer. Conviction and dissent is where the returns lie.

📅 Upcoming virtual events

From time to time, a podcast is just not enough. Check out our roundtables and live events below.

GP/LP Roundtable: Empowering Women in Innovation & Venture | Friday, Jul 5, 2024, 11:00 AM - 12:00 PM (CET) | Register here

Gender diversity in VC isn’t just a buzzword—it's a power move that drives innovation and profitability. 🤘 Balancing the scales in the investment world means more creative solutions and stronger economic growth. Ignoring this is so 2010s. 🕰️

GP/CVC Roundtable on AI in The Physical World | Thu, August 14, 2024, 3:00 PM - 4:00 PM (CET) | Register here

AI is flipping industries on their heads, from health to farming. Get the scoop on what’s real and what’s just sci-fi. With a vertically specialized micro VC, a Robotics CVC with major acquisitions behind him and a generalist who just can’t stay away from the space, you’ll be in the know after listening to this conversation 💸

GP Roundtable: Leveraging AI in Portfolio Monitoring & Management | 📆 Mon, Sep 9, 2024, 3:00 PM - 4:00 PM (CET) | Register here

This roundtable is a must for GPs looking to get an edge using AI. By tapping into AI-driven analytics and predictive modeling, VCs can unlock hidden trends and streamline their operations. Plus, tackling early risk assessment can save portfolios from tanking 💥. It's about staying ahead in a cutthroat world.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

Nordic LP Forum & TechBBQ | 📆 11-12 September | 🌍 Copenhagen, Denmark

How to Web | | 📆 2-3 October | 🌍 Bucharest, Romania

WVC:E Summit 2024 | | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

Invest in Bravery | 📆 22th of October | 🌍 Kyiv, Ukraine

0100 Conference Mediterranean | 📆 28 - 30 October | Milano, Italy

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany

Trying to get in front of European VCs and LPs? The 2024 EUVC Media Kit is out - check it out here, and let’s talk. 💌

On decentralizing the future - Web3 x AI and why does it matter, with Richard Muirhead, Fabric Ventures