In today’s episode, Andreas discusses the importance of ESG in the venture capital industry with our four guests:

Henry Philipson, Director of Marketing and Communications at Beringea

Ashley Brown, Sustainability Manager at Atomico

Antonia Whitecourt, Director at Seedcamp

Grace Savage, ESG Lead at Molten Ventures

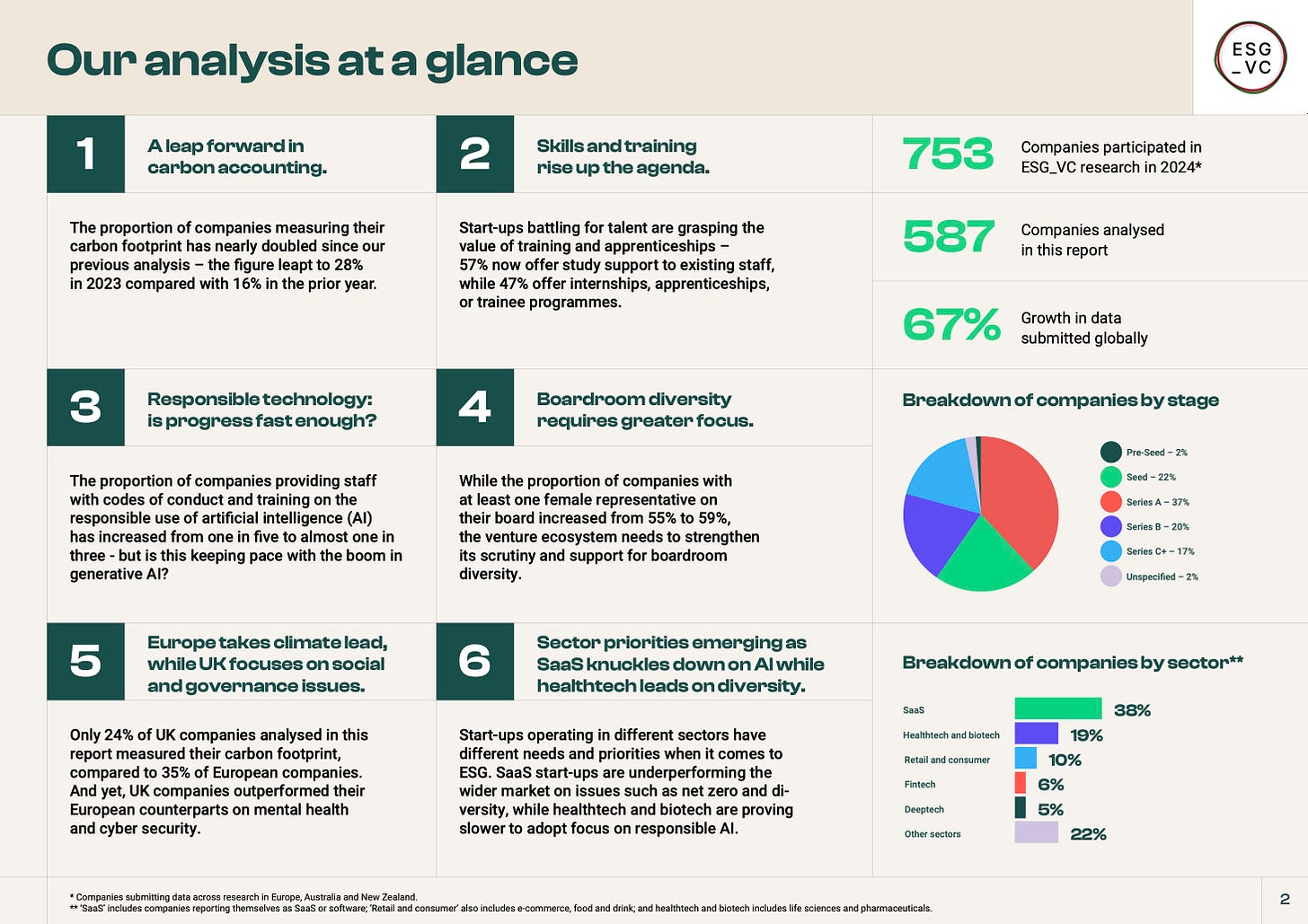

We are talking about ESG in VC because ESG_VC recently published an analysis of ESG data collected from 587 startups backed by leading VC firms, including Atomico, Molten Ventures, Bringea, and Seedcamp. Delivered in partnership with the BVCA and Marriott Harrison, this research produces a detailed analysis of the performance of start-ups against standardized metrics spanning environmental, social, and governance issues.

In this discussion, we’ll bring together ESG leads from some of Europe’s leading venture capital firms to consider:

Where is the value in ESG for start-ups?

How are VCs working with founders to drive the sustainability agenda forward?

What is the future of ESG in European ventures?

… and more that we invite you to discover below.

Watch it here or add it to your episodes on Apple or Spotify 🎧

This episode is brought to you in partnership with Zero One Hundred Conferences, which organizes LP-GP networking events for PE & VC players in various European regions with a global outreach. In the last 8 years, they have hosted 50 events with 1700+ speakers, 6500+ investors, and 12000+ attendees.

The upcoming 0100 Conference Mediterranean presents a unique opportunity for private equity and venture capital LPs and GPs to meet and develop meaningful relationships.

Attendees will include major industry firms such as the European Investment Fund (EIF), Tikehau Capital, Vencap, Arcano Partners, Amundi-Alpha Associates, P101, United Ventures, Merseyside Pension Fund, and many more.

Chapters:

00:34 Deep Dive into the ESG Report

07:11 Importance of ESG in Startups

07:36 Historical Context of ESG

09:15 Operational vs. Strategic ESG

10:19 Challenges and Opportunities in ESG

11:14 Backlash and Misunderstandings of ESG

12:32 Divergence in ESG Practices

16:32 Future of ESG in European VC

19:38 Materiality and Practical Implementation

25:25 Carbon Footprint and Environmental Impact

35:17 Diversity and Talent in Startups

✍️ Show notes

ESG_VC – a global network of more than 300 VC firms enabling start-ups to tackle ESG – recently published its annual research in partnership with the BVCA.

Using data captured from 587 early-stage companies backed by many of Europe’s leading VC firms, the report offers the most comprehensive benchmarking of ESG performance in venture.

In this conversation, we delve into the findings with Beringea, which led the creation of ESG_VC, alongside Atomico, Seedcamp, and Molten Ventures, who are part of the initiative’s leadership team.

Industry reports from our guests.

Conscious Scaling 2.0 - Sustainability Review 2023 by Atomico.

Sustainability Report by Molten Ventures.

Importance of ESG in Startups

ESG factors are becoming increasingly crucial for startups as they provide a framework for sustainability and long-term success. The discussion emphasizes that ESG is not just about regulatory compliance but about building resilient and competitive businesses.

By integrating ESG principles early, startups can attract top talent, access capital more easily, and mitigate various business risks. This holistic approach to business operations ensures that companies are well-prepared for future challenges and opportunities.

Historical Context of ESG

The discussion then moves to the historical context of ESG, tracing its evolution from corporate social responsibility (CSR) to its current form. ESG has roots in responsible investing practices that have been around for decades.

The discussion highlights how the COVID-19 pandemic has accelerated the mainstream adoption of ESG principles, making them a vital part of the investment and business landscape. This historical perspective helps listeners understand the long-standing benefits of building sustainable and responsible businesses.

Operational vs. Strategic ESG

A crucial point discussed is the distinction between operational and strategic ESG. In the context of startups, ESG is often seen as an operational necessity rather than a strategic choice.

Our guests clarifies that while ESG strategies underpin investment processes, including due diligence and portfolio support, the primary goal is to build well-governed, responsible businesses. This distinction helps demystify ESG and positions it as a practical tool for operational excellence.

Challenges and Opportunities in ESG

Challenges include the difficulty in measuring and managing ESG metrics, especially for early-stage startups.

However, these challenges are counterbalanced by significant opportunities, such as enhanced competitiveness, better risk management, and alignment with societal values. Our guests stress the importance of viewing ESG as a journey and encourage startups to start small and scale their efforts over time.

Future of ESG in European VC

ESG in VC is expanding globally, with new groups forming in regions like Australia and New Zealand.

The focus is on creating international standards and providing practical resources for startups. The speakers emphasize the importance of moving beyond the 'why' of ESG to the 'how,' offering toolkits and guides to simplify ESG integration for startups. This forward-looking approach aims to make ESG a fundamental part of business operations.

Materiality and Practical Implementation

Materiality is a key concept in ESG, referring to the relevance of specific ESG factors to a company's business model and operations.

For example, a software company might prioritize data privacy and responsible AI, while a manufacturing startup would focus more on environmental impacts. By honing in on material issues, startups can implement ESG practices that are both meaningful and manageable.

Carbon Footprint and Environmental Impact

One of the standout findings from the ESG report is the significant increase in startups measuring their carbon footprint.

Measuring carbon footprints is seen as a critical step for startups to mitigate risks, comply with future regulations, and enhance their competitive edge. This proactive approach to environmental responsibility is framed as both a moral imperative and a smart business strategy.

Want to learn more about ESG in start-ups and venture?

Here’s four things to get you started:

Watch ESG_VC’s webinars for founders and investors: bitesize introductions to ESG in start-ups, from carbon accounting to ethical use of AI.

Read Balderton’s Start-up Guide to ESG: a useful guide for any company beginning its ESG journey.

Check out the BVCA’s Responsible Investor Toolkit: a quick introduction to responsible investing, with specific advice and insights for VCs.

Get in touch with the ESG_VC team directly: our free membership offers support on everything ESG-related, so do reach out!

📅 Upcoming virtual events

From time to time, a podcast is just not enough. Check out our roundtables and live events below.

GP/LP Roundtable: Empowering Women in Innovation & Venture | Friday, Jul 5, 2024, 11:00 AM - 12:00 PM (CET) | Register here

Gender diversity in VC isn’t just a buzzword—it's a power move that drives innovation and profitability. 🤘 Balancing the scales in the investment world means more creative solutions and stronger economic growth. Ignoring this is so 2010s. 🕰️

GP/CVC Roundtable on AI in The Physical World | Thu, August 14, 2024, 3:00 PM - 4:00 PM (CET) | Register here

AI is flipping industries on their heads, from health to farming. Get the scoop on what’s real and what’s just sci-fi. With a vertically specialized micro VC, a Robotics CVC with major acquisitions behind him and a generalist who just can’t stay away from the space, you’ll be in the know after listening to this conversation 💸

GP Roundtable: Leveraging AI in Portfolio Monitoring & Management | 📆 Mon, Sep 9, 2024, 3:00 PM - 4:00 PM (CET) | Register here

This roundtable is a must for GPs looking to get an edge using AI. By tapping into AI-driven analytics and predictive modeling, VCs can unlock hidden trends and streamline their operations. Plus, tackling early risk assessment can save portfolios from tanking 💥. It's about staying ahead in a cutthroat world.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list; hit us up if you’re going; we’d love to meet!

Nordic LP Forum & TechBBQ | 📆 11-12 September | 🌍 Copenhagen, Denmark

How to Web | | 📆 2-3 October | 🌍 Bucharest, Romania

WVC:E Summit 2024 | | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

Invest in Bravery | 📆 22th of October | 🌍 Kyiv, Ukraine

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany

Trying to get in front of European VCs and LPs? The 2024 EUVC Media Kit is out - check it out here, and let’s talk. 💌

Roundtable discussion on ESG becoming a core part of doing business in Europe