In this episode we’re joined by one of the most honest and dynamic LPs we’ve yet met: Evan Finkel, Head of Venture Capital Investments at Integra Global Advisors. Evan’s based in the US with an Early-stage investment focus - first check to Series A in the US, Europe, Israel, and LatAm. This is a long one and covers a lot of ground from an LP’s perspective, so strap in. Big shoutout to Ophelia Cai from Tiny for the introduction 💖

In this episode, Evan emphasizes the importance of accessing top-tier investment opportunities and the need for a data-informed approach as well as his perspective on the current market conditions, including the deployment slowdown and the potential for a macro TVPI adjustment. The conversation also highlights the importance of having well-defined goals and strategies as a venture capital LP, exploring the principles and considerations important when allocating to venture.

We also discuss how investing in smaller funds yield a higher probability of outsize returns for LPs as well as the stages of investment that Evan believes offer the best value for money while overcoming the challenges of performance dispersion in VC.

Finally, we discuss the classification of ecosystems, why Evan considers Europe an established ecosystem and how he thinks about the challenges and opportunities in different VC markets, concluding on the importance of data-informed decision-making and the importance of separating personal relationships from investment decisions.

Watch it here or add it to your episodes on Apple or Spotify 🎧

Chapters:

02:02 Meet Evan Finkel: Background and Journey

05:37 Building a Global Venture Fund Strategy

09:25 Market Insights and Current Trends

13:08 Challenges and Opportunities in Emerging Markets

17:04 Government Support and Market Distortion in Europe

21:07 Deployment Slowdowns and Capital Management

22:34 First Principles of VC Investment Strategy

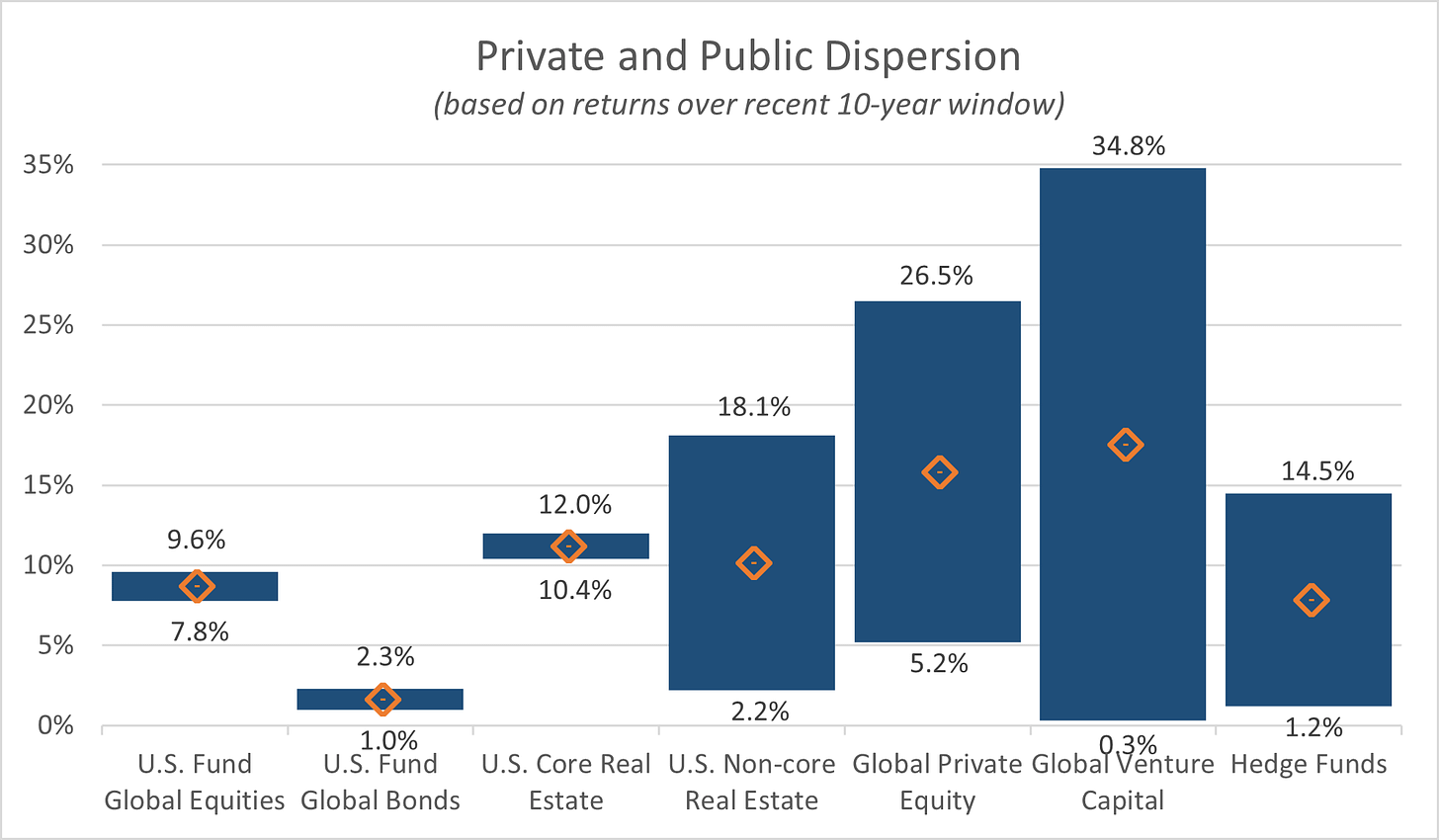

30:47 Performance Dispersion in Venture Capital

38:00 European Venture Challenges

40:44 The Emotional Side of VC

41:47 Balancing Emotions and Investments

44:18 Friends in VC: A Double-Edged Sword

45:50 The Reality of Fund Management

55:32 Operational Due Diligence

01:05:33 Fundraising Strategies for Emerging VCs

01:08:35 The Commitment of Raising a Fund

01:12:07 Counterintuitive Learnings for LPs

✍️ Show notes

Evan’s journey in VC.

Pre-VC: Studied neuroscience and finance in college; spent a few years in consulting at a very quantitative boutique focused on statistical and econometric modeling for multinational corporations; recruited by Anheuser-Busch, oversaw the ROI and attribution modeling for the US marketing budget; went back to school and completed a 2nd bachelors degree in computational and applied math and a masters in machine learning; and, held a software dev role at Amazon

Integra is an IRA functioning as a multi-family office. We serve ultra-high net worth families, foundations, endowments, and pensions. We cover the entire investment universe including liquid equities, fixed income, VC, PE, real estate, private credit, hedge funds, and frontier and esoteric asset classes like litigation finance. On the VC side, we invest in both VC funds and startups.

It’s a complete accident that I wound up in venture but that has allowed us to build our venture program from first principles

Deep Dive and Q&A on Integra GA’s allocation strategy.

We invest in early-stage funds across the US, Europe, LatAm, and Israel

We generally prefer the first few vintages from a given manager and/or small funds - we feel this provides the highest probability of the returns we’re looking to receive

We look for emerging managers but experienced investors (i.e. a referenceable track record as an angel or from a previous firm)

We’re data informed - break down track record, try to identify trends and patterns, areas to poke and prod

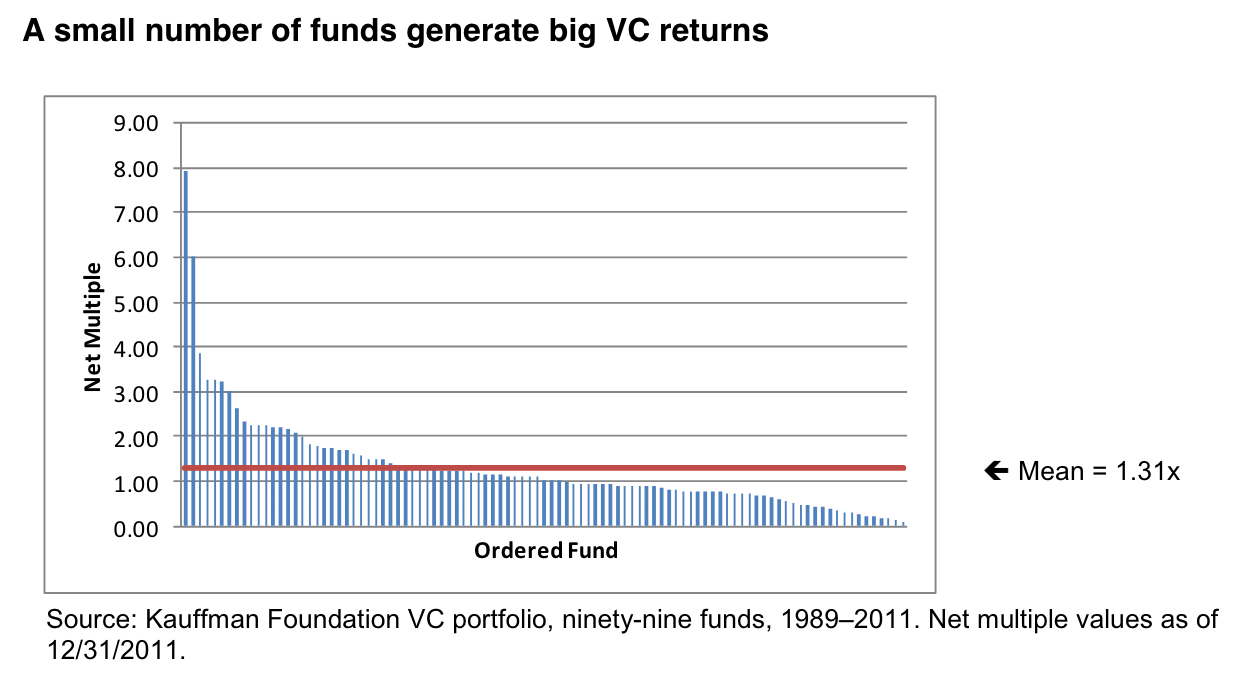

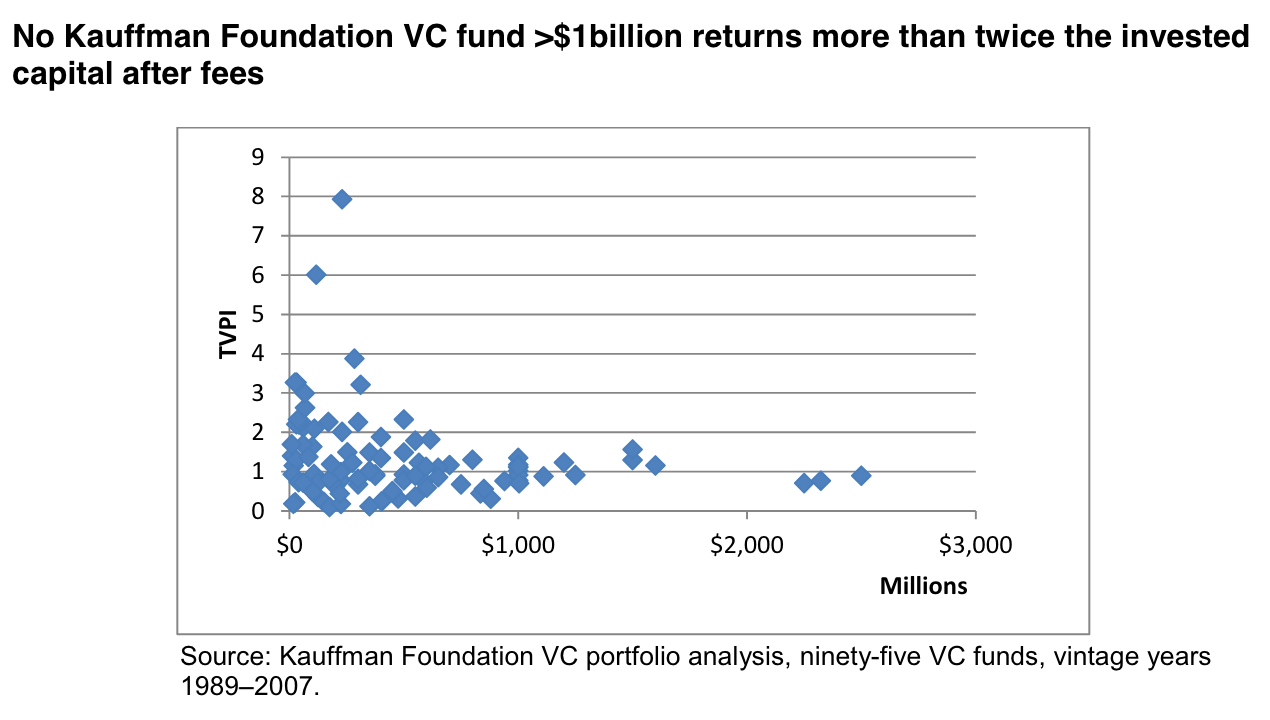

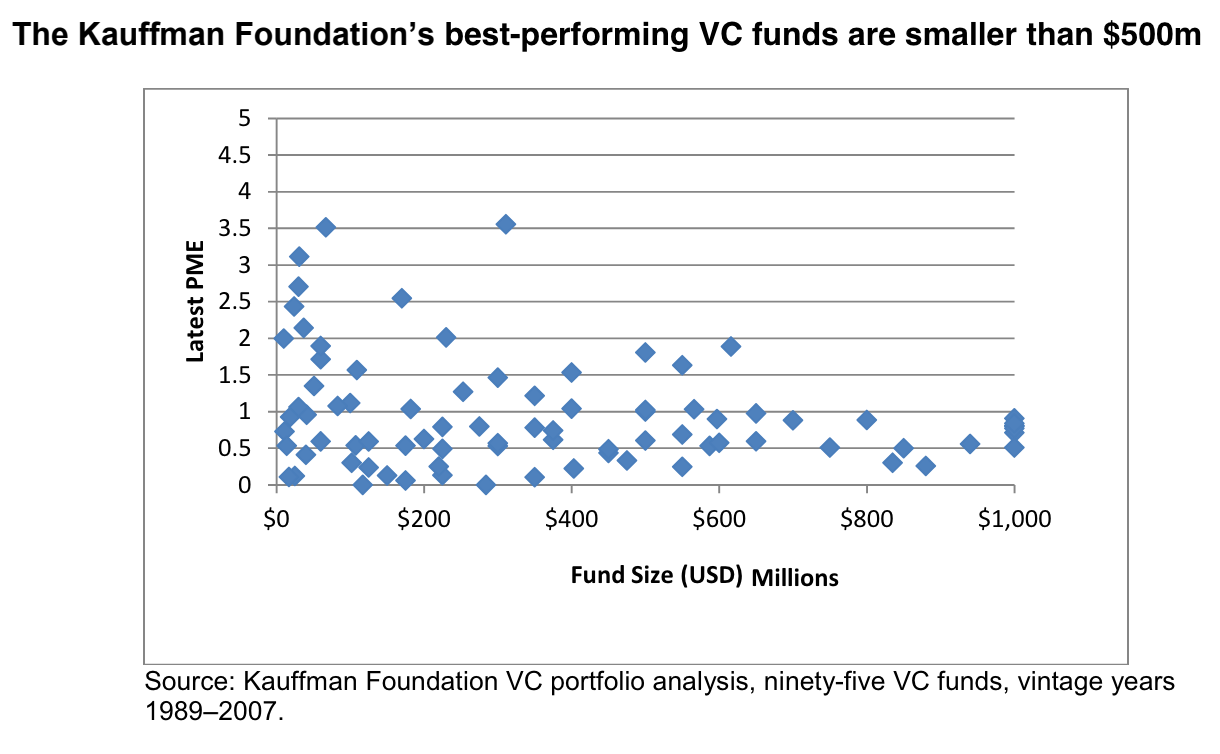

This set is from Kauffman which is dated but reflective of the experience of an actual institutional LP rather than a retrospective analysis from Pitchbook data.

“In our own portfolio, we found that we earned an investment multiple of two times our invested capital only from venture funds whose commitment size was less than $500 million; not a single fund that exceeded that capital raise earned more than twice the invested capital after fees.”

“Our data on the relationship between fund size and returns is supported by other empirical work within the industry. Silicon Valley Bank conducted a study on VC fund size and performance, examining Total Value to Paid In (TVPI) capital returns from 850 VC funds from vintage years 1981–2003. 20 There are three main conclusions to be drawn from SVB’s analysis:

The majority (51 percent) of funds larger than $250 million fail to return investor capital, after fees.

Almost all (93 percent) of large funds fail to return a “venture capital rate of return” of more than twice the invested capital, after fees.

Small funds under $250m return more than two times invested capital 34 percent of the time; a rate almost six times greater than the rate for large funds.”

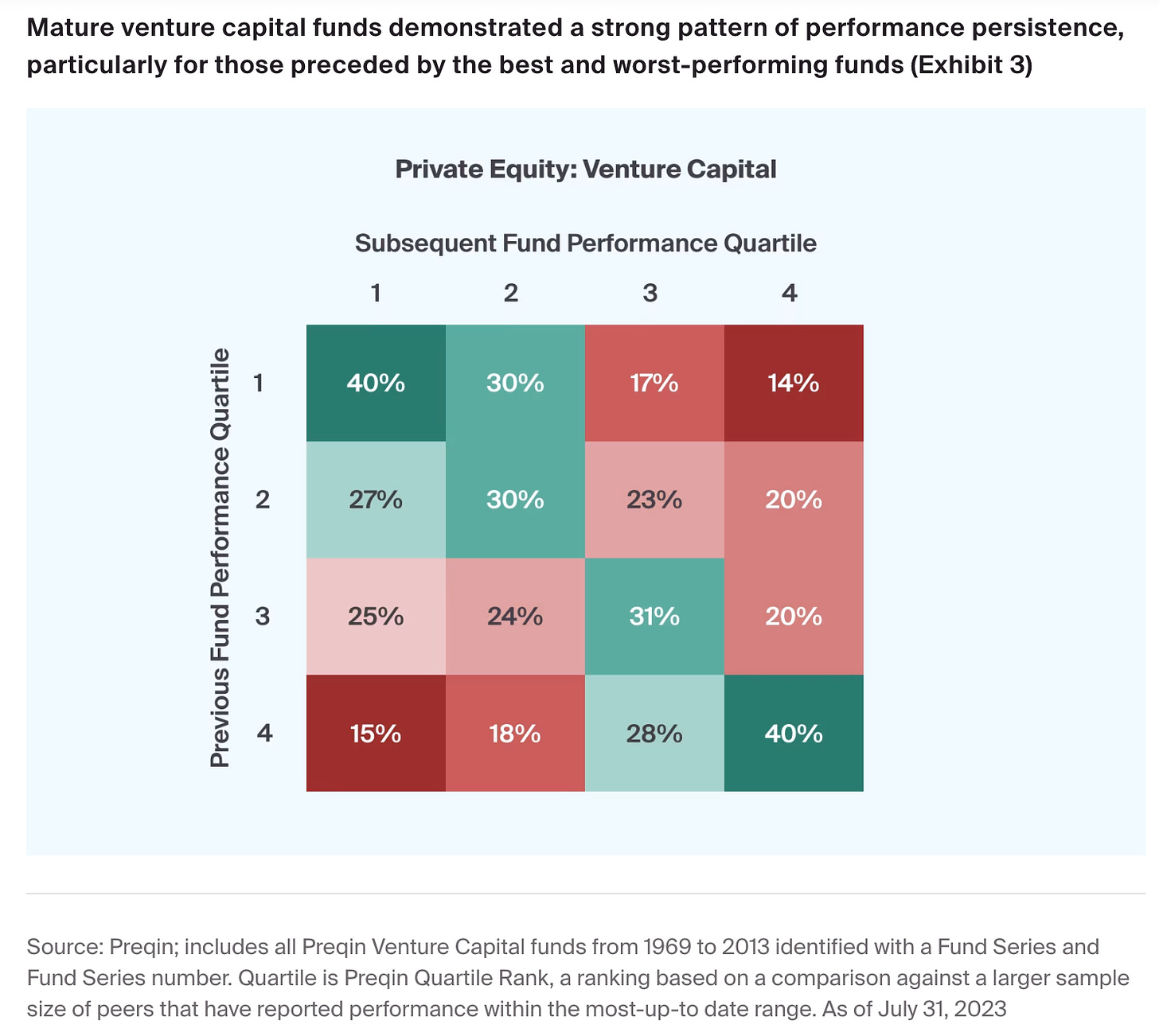

Here’s some data on persistence of fund performance (i.e. ‘settling into a given quartile’ - from here). Things are a bit muddled if the previous fund is in the second or third quartile but the data appears quite strong when the previous fund was in the top or bottom quartile.

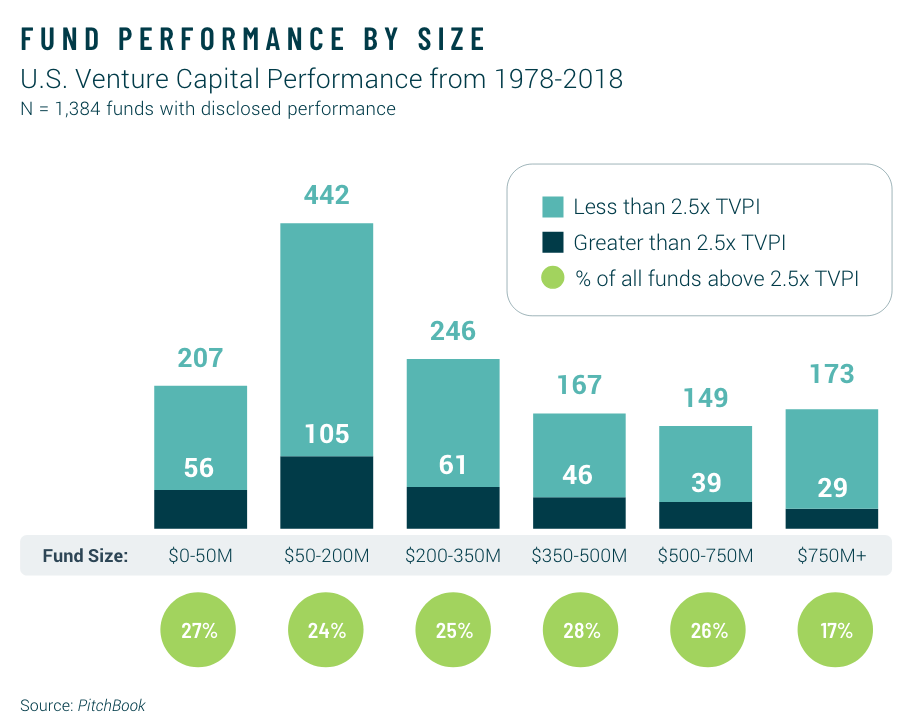

Finally, from Sante on fund size vs. performance:

“Only 17% of venture funds larger than $750M have ever returned to limited partner investors more than 2.5x TVPI net of fees and expenses compared to 25% of funds smaller than $350M. Said differently, a smaller fund is roughly 50% more likely to return more than 2.5x than a large fund.

An even larger performance gap exists when measured by cumulative IRR, which is 17.4% in funds smaller than $350M versus just 9.7% in funds larger than $750M.”

3 biggest learnings in LP investing

GPs are not your friends: Many LPs, even big institutional LPs, confuse being friends with the person running the VC firm and being friends with the legal General Partner entity. It’s great to have friends in venture but those friends have a GP entity that may be charging you real fees, holding onto your money for 10+ years, taking waived management fees instead of a cash contribution from the partners, and strategically using lines of credit and fuzzy valuation policies to manipulate IRR. Make sure you invest in the fund because you believe it’s the best place to actually allocate your incremental dollar not only because you like the person running it.

There are too many ‘sophisticated’ LPs with large asset bases who are too worried about whether the guest WiFi has a password and not nearly enough about whether the investment thesis of the fund makes any sense…don’t invest in a fund just because one of these institutions invested.

Most LPs don’t understand the purpose of venture in a diversified portfolio or are willing to write checks that aren’t going to generate venture-scale outcomes. Unless you’re in the types of funds (small and early-stage) that have the highest probability of generating outsized, asymmetric returns, you’re better off investing in real estate or private credit and getting the same or better returns with regular cash distributions.

Advice to your 10 year younger self.

Strap in, it’s going to be a wild ride…but also, chill out, it’ll all (probably) be fine

The PhD which you’re going to want to get in a few years…don’t wait

That weird crypto thing…maybe start mining it right now?

Top tips for emerging VCs fundraising.

Spend a lot of time thinking about whether you want to be an investor or a fund manager - everyone wants to have their own fund but that is a full time job on top of your job being an investor. You might be a lot happier just deploying capital and not having to worry about fundraising, operations, compliance, etc.

Honestly answer the following questions: Do you actually have a unique and differentiated advantage? No, really, do you? Are you sure? Can you articulate it?

Most counterintuitive learning.

The incentive misalignment between GPs & LPs and LPs & underlying beneficiaries is even worse than it appears

LPs have access to more data than ever before but many seem to key in on who else is investing in a fund, which firms have co-invested with the fund, and which unicorns are in the portfolio

📅 Upcoming virtual events

From time to time, a podcast is just not enough. Check out our roundtables and live events below.

GP/LP Roundtable: Empowering Women in Innovation & Venture | Friday, Jul 5, 2024, 11:00 AM - 12:00 PM (CET) | Register here

Gender diversity in VC isn’t just a buzzword—it's a power move that drives innovation and profitability. 🤘 Balancing the scales in the investment world means more creative solutions and stronger economic growth. Ignoring this is so 2010s. 🕰️

GP/CVC Roundtable on AI in The Physical World | Thu, August 14, 2024, 3:00 PM - 4:00 PM (CET) | Register here

AI is flipping industries on their heads, from health to farming. Get the scoop on what’s real and what’s just sci-fi. With a vertically specialized micro VC, a Robotics CVC with major acquisitions behind him and a generalist who just can’t stay away from the space, you’ll be in the know after listening to this conversation 💸

GP Roundtable: Leveraging AI in Portfolio Monitoring & Management | 📆 Mon, Sep 9, 2024, 3:00 PM - 4:00 PM (CET) | Register here

This roundtable is a must for GPs looking to get an edge using AI. By tapping into AI-driven analytics and predictive modeling, VCs can unlock hidden trends and streamline their operations. Plus, tackling early risk assessment can save portfolios from tanking 💥. It's about staying ahead in a cutthroat world.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

Nordic LP Forum & TechBBQ | 📆 11-12 September | 🌍 Copenhagen, Denmark

How to Web | | 📆 2-3 October | 🌍 Bucharest, Romania

WVC:E Summit 2024 | | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 October | 🌍 Dubai, UAE

Invest in Bravery | 📆 22th of October | 🌍 Kyiv, Ukraine

0100 Conference Mediterranean | 📆 28 - 30 October | Milano, Italy

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany

Trying to get in front of European VCs and LPs? The 2024 EUVC Media Kit is out - check it out here, and let’s talk. 💌

A global LP's perspectives, allocation strategy and learnings with Evan Finkel, from Integra Global Advisors