Celebrating not only their 500 M€ Fund VII but also their role as finalist in the Firm of The Year category at this year’s European VC Awards, we talk to Creandum’s Beata Klein about how AI will impact the B2B SaaS space and why she believes there’s big opportunity in the horizon(tal).

With its impressive track record of identifying Europe’s breakout companies, such as Spotify, Depop and Klarna, Fund VII was oversubscribed and backed by 30 of the world's top LPs with more than half of the capital raised from US investors. Creandum’s investor base includes 5 out of the 8 largest US university endowments, pension funds and foundations🤘

The news come at a time where VC investment remains significantly down from 2021 highs, making the closure of Creandum’s latest fund demonstrate an appetite from the world’s top investors for exposure to European tech, particularly at the early stages. Nearly a third of all seed funding globally goes to European startups and Europe is home to more than 500 unicorns across 65 cities and 25 countries (Source: Dealroom Creandum report, July 2023).

AI, SaaS and climate tech startups have been driving increases both in dealflow and valuations in the region. Creandum has recently led or participated in:

French AI startup H’s $220m seed stage round (here much more about this in our company in our conversation with Xavier from Elaia)

German SaaS company Codesphere’s $18m Series A round;

Spanish FinTech Embat’s $16m Series A round; and

UK AI company, Atla’s $5m seed round fresh out of Y Combinator

Creandum has invested in ten climate tech companies over the last three years including Enode, Twaice, Fuse Energy and Monta.

Commenting on the fund closing, Sabina Wizander, Partner at Creandum said:

“Our 7th fund represents the continuation of a 20 year strategy that has seen us back many of Europe’s most ambitious founders from the beginning of their journeys. Our funds have consistently delivered industry leading returns. We compete locally for the best entrepreneurs across Europe, but we compete globally for the best investors in our funds. We were significantly oversubscribed and continue to be backed by some of the world’s best LPs who value our consistency and track record of identifying and supporting Europe’s top entrepreneurs.”

Like previous funds, Creandum VII aims to make 35-40 investments at Seed and Series A over the next two to three years. Creandum takes a generalist approach, supporting entrepreneurs building global, category-defining companies across a range of sectors. One in six of Creandum’s early stage investments have turned into billion dollar companies or more. It has consistently backed many of Europe’s stand-out technology companies, including Spotify, Klarna, Depop, Neo4J, Pleo, Trade Republic and Bolt.

Sabina Wizander, added:

“It’s been a tough few years for venture but we continue to see a massive opportunity in Europe. There is a new generation of entrepreneurs emerging from Europe’s breakout companies such as Spotify and Revolut combined with an incredible concentration of scientific and engineering talent. There’s never been a better time to invest in European tech.”

Quick stats on Creandum:

Founded in 2003, Creandum is a leading pan-European early-stage venture capital firm.

The firm’s portfolio of 150+ companies includes some of Europe’s most successful tech companies across a wide range of industries, including Spotify, Klarna, Depop, Trade Republic, Pleo, and neo4j.

Today, every sixth company is a billion dollar company or more. Creandum's advisory teams are based in Stockholm, London, Berlin, and San Francisco and offer extensive operational expertise to support the funds’ portfolio companies from seed to exit to become global category leaders.

In this episode, we dive deep into Beata’s article “AI in B2B SaaS: Beyond Vertical and into the Horizon(tal),” which we reproduce below together with the rest of the show notes.

Watch it here or add it to your episodes on Apple or Spotify 🎧

Big shout out to our Firm of The Year Sponsor Haynes Boone.

Don’t take it from themselves, take it from one of their long-term clients, Joe Schorge:

"Having worked together for many years now, they fully understand the Isomer ethos and process, and we really appreciate the value that this long-term relationship brought to this mandate from start to finish. We look forward to continuing to work with Karma, Ronan, Will and the rest of team.”

Naturally, we’re incredibly excited about having the Haynes Boone team with us as sponsors of the Firm of The Year Awards - yet another testament to their support for the EUVC ecosystem. We strongly encourage you get in touch with Karma and the team for a great experience 🔥

Chapters:

01:05 Deep Dive into AI and Horizontal vs Vertical SaaS

04:27 Beata's Insights on B2B SaaS and AI

06:15 The Future of AI in Horizontal SaaS

07:22 Challenges and Opportunities in AI Integration

09:15 Exploring Legacy Systems and New Innovations

20:31 Legal Tech and AI: A Disruptive Force

32:39 AI First Approach: The Future of User Interfaces

33:23 Revolutionizing the Internet: Human vs. Agent Interaction

35:10 Blockchain and AI: A Seamless Future

35:48 Tailwinds in AI: Adaptability and Data Ingestion

37:28 The Power of AI in Data Ingestion

41:03 AI in Compliance: Disrupting Legacy Systems

42:44 Horizontal vs. Vertical AI Applications

47:50 The Future of AI: European vs. US Models

51:48 Work-Life Balance and Career Growth in VC

59:06 Advice for Aspiring VCs: Embrace Failure and Specialize

✍️ Show notes

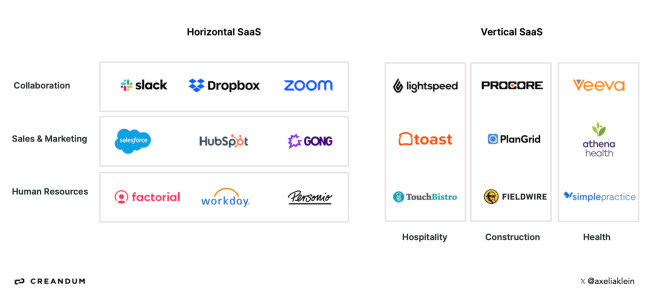

In B2B SaaS, two concepts have been making waves: Vertical SaaS and AI. There's no denying the potential that lies at the intersection of these two trends. In this article, we will explore the reasons behind this synergy and why this is so promising. We will also explore the relatively uncharted waters of AI in Horizontal SaaS, a territory often dismissed due to the dominance of incumbents and platform risks.

Vertical vs. Horizontal SaaS

It's essential first to understand the distinction between Vertical and Horizontal SaaS. Vertical SaaS is specialized software tailored to a specific industry, whereas Horizontal SaaS offers a broader set of functionalities applicable across various industries.

Horizontal vs. Vertical SaaS

The Excitement Around Vertical SaaS

Vertical SaaS companies customize their offerings to solve sector-specific challenges. This deep understanding of the industry nuances, regulatory landscapes, and targeted problem-solving capability often translates into a strong, vertically integrated value proposition, increasing switching costs and reducing customer churn.

Vertical SaaS companies have gained a lot of attention for many good reasons:

Leveraging industry-specific data: Vertical SaaS gains a competitive edge by accessing and fine-tuning models on proprietary datasets which creates a barrier against potential competitors

Deep Domain Expertise: Models are tuned for specific use cases, while the leadership team possesses an intimate understanding of the customers which results in a superior product experience, often exceeding expectations.

Market Penetration Potential: Vertical markets often have low penetration levels. With AI as a catalyst, businesses can establish a substantial presence in these untapped territories.

Low Customer Acquisition Costs (CAC): Targeted marketing in Vertical SaaS keeps CAC low, allowing newcomers to compete effectively against incumbents bundling products.

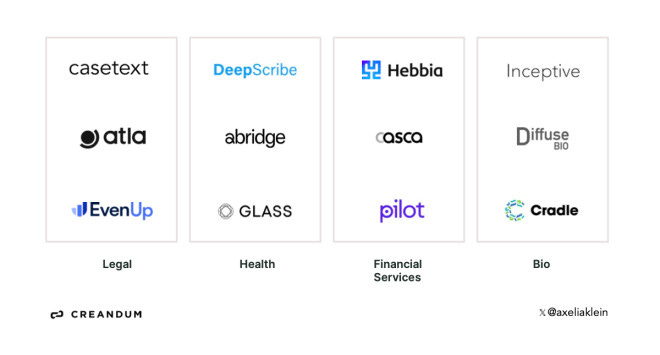

The resulting opportunity to gain market share by delivering a 10x improvement where previously incremental innovation was the norm has led to an explosion of AI-first companies across a number of categories within vertical SaaS.

Examples of B2B Vertical AI companies

What about Horizontal SaaS?

Horizontal SaaS has received less attention. The prevailing argument suggests that incumbents control both data and distribution channels, while access to Large Language Models (LLMs) is both commoditized and with platform risks. An opportunity for horizontal software is mainly seen in middleware and infrastructure, which allow for developer-led customization and can be altered to cater to specific use cases.

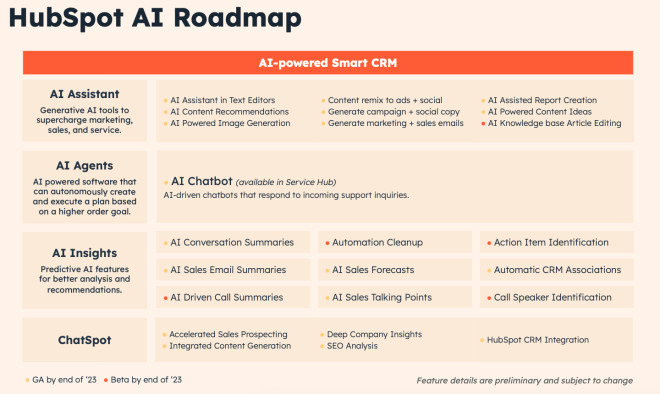

Compared to the shift to the cloud, which yielded a vast number of category-defining companies, existing horizontal SaaS players have been quick to adopt this technology while leveraging existing customer data. As Christoph Janz emphasised previously, in contrast to the shift from on-prem to cloud, adding generative AI features to your product does not require a complete rebuild but in many cases just calling some open APIs. A case in point are companies like Intercom, Hubspot, or Zendesk - all horizontal SaaS companies that demonstrated how rapidly existing players can adapt and implement LLMs.

Hubspot AI features

End of story?

LLMs have enabled a fundamental shift in the way companies interface with software. From a first principles perspective, what really is a SaaS application? It's data and workflows. Now, with chat-based interfaces and agents, the way users interact with data and how these workflows are carried out is changing fundamentally. This is leading to the emergence of software categories where the dominant feature will be AI, with companies wowing users from the get-go by delivering a previously unthinkable product experience. With that shift, new opportunities in horizontal software emerge.

We are convinced the story doesn't end there.

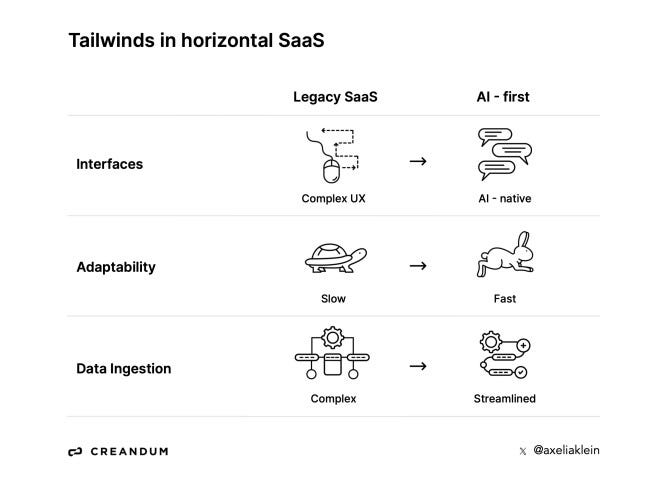

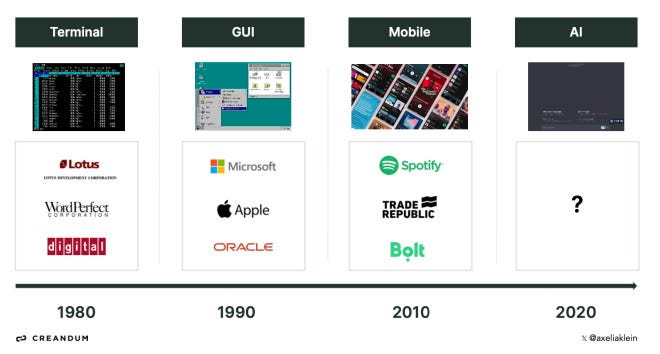

AI-First Interface: Startups can leverage AI to build products that captivate users from the outset. New technology enables novel interfaces. Potentially comparable to the shift from the command line -> graphical user interfaces (GUIs) -> mobile, and how a new technology introduced software with a look and feel which is vastly different than before

Adaptability vs. Legacy: As companies grow, they tend to lose agility and the ability to pivot swiftly. This opens the door for startups to replace legacy companies in established industries. While existing scale-ups, such as an Intercom, can adapt rapidly and implement LLMs, the same isn’t necessarily true if you are replacing software that has been around for 10+ years

Data Ingestion: Historically, data ingestion has been a substantial challenge in selling to enterprises, but recent advancements have reduced switching costs.

Tailwinds in horizontal SaaS

What can we learn from previous platform shifts?

AI first UI / UX / Innovation

Although already seemingly ancient history, a comparison to the transition from command-line interfaces (CLIs) to graphical user interfaces (GUIs) might not be too far-fetched. Prior to GUIs, interactions with computers required a deeper understanding of command-line syntax, which was often intimidating for the average user. GUIs introduced visually intuitive elements like windows, icons and menus, which allowed users to engage with software in a more instinctual, point-and-click manner. This newfound ease of use stimulated a massive demand for user-friendly software applications, leading to an explosion of new software products and startups.

Previous UI / UX shifts

We might now be seeing a return to the purest form of human-machine interaction. But instead of lines of code, the input has changed to natural language. Where earlier AI interactions often required specialized knowledge or specific input formats, LLMs offer a more natural, conversational mode of engagement. Users can communicate with these advanced models in plain language, much like they would with another human, eliminating the steep learning curve previously associated with AI.

Looking ahead, the jury is still out on whether prompting will remain the primary way to interface with LLMs. Prompting might be replaced by other 'in context' interfaces, each adopting or adapting to the specific use case. Either way, we believe new horizontal products can emerge that enable a 10x better UX/UI experience, by redefining what interaction between data and users looks like.

Adaptability vs. legacy

As we witnessed in the transition from on-prem to cloud, incumbents are often subject to decades of ingrained processes, deep-rooted systems, and a culture resistant to change. This gave a strategic advantage to agile startups, which, unburdened by legacy infrastructure, were able to capitalize on the cloud's scalability, cost-efficiency and global reach to deliver innovative solutions that led to the creation of generational companies such as ServiceNow, Twilio, or Atlassian.

As mentioned, established companies like Hubspot or Zendesk have been quick to adopt AI. In enterprise specifically, however, customers are still often serviced by legacy incumbents that are facing sunk cost fallacy and potential innovators dilemmas. Although less prevalent than during previous platform shifts, we still see potential gaps in the market opening up for startups to capitalize on the organizational inertia of incumbents particularly in enterprise software.

Data ingestion

Over the past years, data ingestion in enterprise software has seen remarkable improvements thanks to several converging factors. Advanced integration platforms and tools have become more prevalent, offering plug-and-play solutions for data migration. Enhanced APIs and standardized data formats promote smoother data exchange between disparate systems.

With new advancements in AI it is now also significantly easier to take unstructured data that sits in PDFs or other static formats and turn them into structured data. This evolution has a direct impact on reducing switching costs for enterprises. Whereas in previous platform shifts, data ingestion and migration were cumbersome and served as a substantial moat for incumbents, suddenly companies can find it easier to transition between software solutions without the fear of data loss or extensive downtimes.

Changing Landscape in Enterprise

New AI startups have the unique chance to captivate users from the get-go by redefining user interaction. Much like previous seismic shifts such as command line to graphical user interfaces (GUIs) or the emergence of mobile, AI is unlocking new opportunities in both vertical and horizontal SaaS. This is fueled by the organizational inertia of incumbents and reduced switching costs due to improved data migration and ingestion infrastructure.

Horizontal SaaS typically addresses expansive markets, offering opportunities to build substantial companies. While the barriers may seem formidable, the potential rewards are equally great. We are already seeing a glimpse of what the next generation of horizontal software might look like with companies such as Beam AI, induced, or Adept reimagining the interplay of workflows, data, and users - regardless of vertical.

The LLM (r)evolution is a substantial pivot towards a more efficient, innovative and competitive market space. For startups, this is nothing short of a clarion call to action, as we are convinced that the market is ripe for the taking.

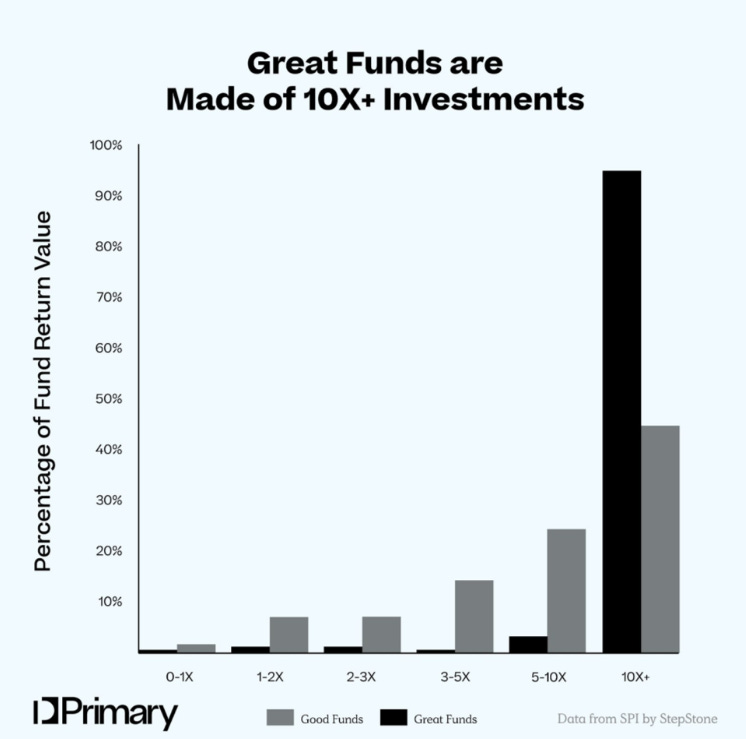

Category-defining companies

At Creandum, we look for products and solutions capable of delivering a 10x better experience. Vertical AI undoubtedly holds the promise of deeper market penetration in underserved industries. However, we also firmly believe in taking bold bets that can topple the giants of the software world and give rise to a new generation of category defining companies.

Co-authored by Beata Klein and Richard Keuntje.

If you are a company building in this space and want to chat let us know!

References:

Generative AI: An Asteroid Impact Event on B2B Software - Christoph Janz

Will AI Accelerate Vertical SaaS Adoption? - Christoph Janz

Second-order effects of AI in Vertical SaaS - Akash Bajwa

Product-Led AI - Seth Rosenberg

AI is Reinventing the Legal Industry - Morgan Beller and James Currier

Vertical AI: The next logical iteration of vertical SaaS - Paris Heymann

Horizontal vs. vertical AI - Krishna Nadakumar

10 Lessons from a decade of vertical software investing - Brian Feinstein and Caty Rea

Is AI generation the next platform shift - Bhavik Nagda, Lucy Pless and Talia Goldberg

Vertical(ai) is the new horizontal - Rajeev Dham, Jason Brooke and Andrew Vogeley

Shout-out

Carmen Alfonso Rico

SoloGP at Cocoa

Most hustling and generous person I know

And also very conviction driven and true to her hypothesis which is very refreshing in VC Besides investing she also manages to build her own brand whilst staying genuin and true to her values

3 biggest learnings from last 10 years in your life

Someone said to me: "Don't overestimate competition" - and it stuck, as sometimes you are afraid to take chances (like apply for that job/MBA etc.) just becasue you feel competition would be so fierce but if you don't try you don't even have a shot

Don't strive for work-life balance early in your career - save that for later when you have a family and you need to optimise for other ppl in your life,

Find mentors/peers outside of your own company, and learn from others whom you admire - this is a true game changer to speed up your learnings

Advice to young people in the industry

We are in the business of saying yes (even if there is a million reasons to say no) one has to remember this

Be ready to fail

If VC is analysing deals, sourcing deals, winning deals you need to be outstanding at one of

Top tips for VCs building their career in venture?

Very much also still learning but a few things I try to keep in mind:

It is near impossible to see all deals, sometimes you just have to face the fact that 100% coverage isn't something you should aim for

You can always do more, one more outreach, one more call, but try to set the bar high, don't meet with "can do deals" but only "must do deals"

Most counterintuitive learning

So much about venture is becoming good at handling failure and that you were wrong

Some of the best investors in the world make 9 investments that are all pretty bad and then the 10th is the homerun

Process matters, even if results might not show yet, so sticking to it seems key

In the meantime you also have to have patience to see how companies develop over time and not write off a company too early

👋 Upcoming in-person events we’re hosting

There’s nothing we like better than getting Europe’s best and brightest together with good food, drinks, and conversations that go truly deep.

SuperVenture Side event on Realizing DPI | 5th of June | 🌍 Berlin, Germany | Join the waitlist.

European VC Awards | 4th of June | 🌍 Berlin, Germany | Get tickets.

📅 Upcoming virtual events

From time to time, a podcast is just not enough. Check out our roundtables and live events below.

🏆 Firesides with the winners of the European VC Awards

Fireside with the Newcomer of the Year Winner | 13/6, 12-1:30 PM | Register here. Hundreds of new VC funds come to market every year. But only ONE will win Newcomer of The Year. This is your chance to meet the winner firsthand.

Fireside chat with the Winner of the Hall of Fame | 25/6, 12-1 PM | Register here.

Hear firsthand from a true giant upon whose shoulders the European tech ecosystem stands tall.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

SuperVenture | 📆 4 - 6 June | 🌍 Berlin, Germany

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen, Denmark

How to Web | | 📆 2-3 October | 🌍 Bucharest, Romania

WVC:E Summit 2024 | | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

Invest in Bravery | 📆 22th of October | 🌍 Kyiv, Ukraine

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany

Trying to get in front of European VCs and LPs? The 2024 EUVC Media Kit is out - check it out here, and let’s talk. 💌

Creandum rolls out 500M€ oversubscribed fund VII & Snags Firm of The Year Finalist position - in conversation with Beata Klein on AI in B2B SaaS: Beyond Vertical and into the Horizon(tal) 🌅