Celebrating a new finalist in the Firm of The Year category at this year’s European VC Awards, this episode dives deep with Max Bautin, co-founder & Managing Partner of IQ Capital.

IQ Capital is investing out of a 185 m€ Fund 4 and also has a 150 m€ Growth Opportunities fund and has an established portfolio of over 60 companies and notable investments, including Thought Machine, Paragraf, and Nyobolt.

IQ Capital at a glance

$1B AUM

$2B co-investment into IQC portfolio, +$10B of enterprise value created

+20 exits to date & +200 equity rounds invested

A team with over 200 years of experience in investing & operating since 1996

A proved strategy: Growth Fund I is strongly performing

A good track record of delivering: top decile net returns.

We previously met with Max to discuss his journey into venture capital, the founding story behind the fund, and more insights into the Cambridge Mafia and the Cambridge ecosystem. You can watch our previous conversation with Max here.

Watch it here or add it to your episodes on Apple or Spotify 🎧

Big shout out to our Firm of The Year Sponsor Haynes Boone.

Don’t take it from themselves, take it from one of their long-term clients, Joe Schorge:

"Having worked together for many years now, they fully understand the Isomer ethos and process, and we really appreciate the value that this long-term relationship brought to this mandate from start to finish. We look forward to continuing to work with Karma, Ronan, Will and the rest of team.”

Naturally, we’re incredibly excited about having the Haynes Boone team with us as sponsors of the Firm of The Year Awards - yet another testament to their support for the EUVC ecosystem. We strongly encourage you get in touch with Karma and the team for a great experience 🔥

Chapters:

00:03 Meet Max Bautin of IQ Capital

00:42 IQ Capital's Deep Tech Investments

04:48 Deep Tech Trends and Challenges

05:15 Investor Interest in Deep Tech

06:33 Risks and Rewards in Deep Tech

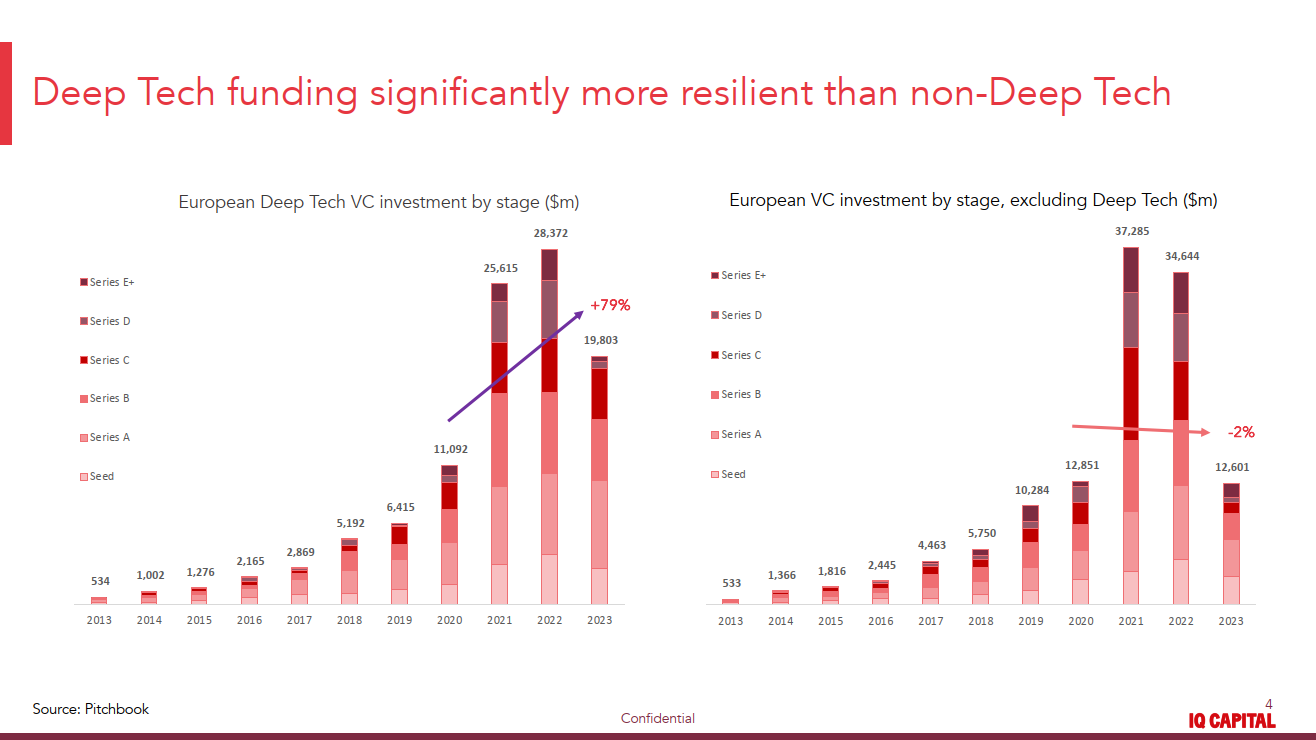

16:23 Deep Tech Funding Resilience

20:24 Hardware and Materials in Deep Tech

28:11 Aerospace and Defense Innovations

41:00 Space as a Market: Strategy and Evolution

41:49 Starlink and SpaceX: Beyond Rockets

43:11 Innovations in Space Access and Manufacturing

44:33 The Rise of Robotics and AI

46:03 Investing in Robotics: Challenges and Opportunities

50:13 AI and Robotics: Hype vs. Reality

52:32 Exploring Computational Biology and Tech Bio

58:42 Deep Tech Software Trends

01:06:05 Managing VC Funds: Strategies and Challenges

✍️ Show notes

Deep Tech trends & Portfolio themes

Not all of the increased Deep Tech investment is likely well-targeted, we look for investments that:

Have evidence of significant, global market demand “if this works, will it be a meaningful company?”

The products, when commercialized, set a new performance standard (delta requirement depends on context) and have transformative potential in respective markets

are non-obvious, hard to copy (or protected with core IP), and show compounding gains with scale (product, supply chain, and business model moats)

have a realistic and flexible product roadmap – time and capital efficient path to MVP

have teams with technical brilliance alongside the ability to build a convincing narrative about why their invention matters in the context of macro trends. Ability to market a movement.

Thinking about technology trends is at the heart of IQ Capital. The team tracks promising research directions in fields where a plausible market-timing argument can be made, with a focus on cross-disciplinary science. Critically, we remain founder-opportunity led on a case-by-case basis – the market knows more than we ever will.

Why is Deep Tech on the rise?

Startups have become better at breaking into the complex, often global supply chains, of ‘old’ industries which are in turn more open to incorporating new third party technologies. Early contracts trending larger, and for multiple years

Scientific advances in machine learning, computational biology, materials, and advanced engineering have created a platform for companies to build, test, and iterate deep tech products more quickly and cheaply – driving value in techbio, space and aerospace, and robotics amongst others.

Space-tech sector is still booming. Launch costs are decreasing and there is a growing acceptance of new technical approaches.

Productisation in Quantum Computing has been slower, but seeing breakthroughs and traction in other domains such as quantum sensing and quantum networking.

Scale-up challenges remain, especially at late-stage funding, manufacturing and distribution.

There is an increasingly fragmented global supply chains and markets.

Example Deep Tech themes

Aerospace & Defence incl Dual Use Technology

Partnership with NSSIF since its creation in 2019, In-Q-Tel and others

IQ Capital leading in best practice: UK Defence Investor Network

IQ Deep Tech thesis in defense: build and scale important technologies for dual use, engage with defense when customer requirements map to capabilities. Urgent focus on market validation early, e.g.investing in space on upstream and downstream side, avoiding high-capex and competitive launch market.

Tech Bio / Health / Computational biology

AI is disrupting how companies are built and scaled in life sciences.

Life science sector has strengthened significantly in the public markets since 2023 - larger companies now have very strong balance sheets.

Industry is expecting a healthy M&A environment and an increase in partnerships & commercial engagements with earlier-stage companies.

We see high quality commercial and partnership engagements driving portfolio companies to achieve key milestones, unlocking successful funding rounds.

We see deep tech opportunities at the intersection of computation and biology - often in life science tools & software.

Massive commercial and investor interest in this area only expected to grow, we are very positive on this space through 2024.

AI as a Horizontal

AI is foundational to Deep Tech, not a separate category – it’s a tool.

AI is here to stay:

2024 will see LLMs and visual gen AI migrate to smart phones (vs. cloud).

regulation/standardization goes mainstream.

acquisition.

Challenges:

AI to impact 60% of advanced economy jobs (IMF).

Rise of agentic AI, in 2024 too expensive to replace most knowledge jobs but directionally right.lobbying and gatekeeping.

competition and capital.

IQC perspective:

application AI vs novel AI.

It’s not all about data.

A killer app drives big outcomes, research breakthrough is an enabler.

Future thoughts:

Deep Tech has become a mainstream investment strategy.

Challenging fundraising environment, especially at later stages.

Funding rounds are happening at all stages, and on reasonable terms.

Not the best time to exit unless have to, or strong in-bound.

We expect UK/EU Deep Tech to continue to out-perform.

Core Learnings on Managing Funds Through the Full Fund Lifecycle

Long-Term Perspective and Patience

Intrinsic Time Horizon:

VC demands long-term commitment: Unlike other investment vehicles, venture capital requires a multi-year horizon. Understanding that returns are not immediate is crucial for setting realistic expectations.

Typical journey spans a decade: Building a substantial, high-value company often takes around ten years, reflecting the time needed for productisation (typically 1-4 years in our portfolio), growth, market penetration, and scaling.

Particularly relevant for deep tech: Deep tech ventures have extended development cycles due to the complexity and innovation involved, requiring patience before significant revenue generation begins.

Fund Lifecycle Realization

Extended Fund Lifecycles:

Average venture fund lifespan: Data indicates the average age of a venture fund to full termination is about 16-18 years (general VC), so 10/12 years in typical fund legals is very much a concept already. Key is how long it takes to realize 80%+ value in any fund. Many Deeptech verticals take similar time to scale/exit as eg conventional software

Strategic realizations: Timing the realization of core assets is critical to avoid premature liquidation and to maximize returns, leveraging the full growth potential of investments.

1x DPI target: we aiming for at least 1x Distributed to Paid-In (DPI) capital within eg 8 years from first close provides a tangible milestone, considering a typical investment period spans six to seven years.

Alignment with LPs’ Interests:

Shift from management fees to upside potential: Beyond the ten-year mark, the focus should move from meaningful management fees to generating substantial returns, aligning with LPs’ expectations for significant upside with GPs economics.

Align GP incentives with LP goals: Prioritizing optimal investment outcomes over rapid exits ensures that GPs and LPs share a common objective, fostering trust and long-term collaboration.

Cease management fees after 10+2 years: This approach motivates GPs to maximize the portfolio’s value and ensures that the focus remains on generating returns rather than collecting fees.

Managing Late-Stage Funds

Challenges and Major Outcomes:

Significant outcomes materialize around year ten: Fund 1’s (2007 vintage) largest returns came in its tenth year, emphasizing the importance of planning your investment programme carefully in the early years

‘Fund-returner’ mentality for every investment: In Fund 1, Grapeshot’s exit at twice the fund’s value (“double-dragon”) was pivotal to delivering top decile LP returns. For Fund 2, Thought Machine’s 3.5x fund-level return (to-date - not fully realized yet), Fund 3 and Fund 4 have emerging candidates as well. Venture is a game of outsized returns and every investment should have that promise.

Multiple large performers in Fund 2: Having several high-performing investments reduces reliance on a single outcome and increases the likelihood of achieving overall fund returns beyond 5x.

Fund 2 Performance and Strategy:

Strategic decision-making for exits: Deciding when to realize gains from high-growth investments like Thought Machine involves balancing immediate returns with potential future value.

Utilize secondary liquidity: Secondary liquidity in growth-stage rounds offers an avenue to balance continued growth exposure with the need for partial liquidity, allowing GPs to manage risks and returns effectively.

Secondary Liquidity and Continuation Vehicles

Strategic Secondary Liquidity:

Principles for secondary sales: Establishing a framework where secondary sales occur when valuations reach at least five times the initial investment ensures that significant value is realized without overly diluting future growth potential.

Sell no more than 20% initially: Limiting the initial sale to 20% of the stake, at a minimum pre-set EV target (say min 5-10x multiple of first cheque), secures returns/generates early liquidity while maintaining a substantial position for future growth, optimizing both current and long-term gains.

Subsequent liquidity opportunities at high valuations: Planning for additional secondary sales at valuations exceeding a threshold of ‘x’ ($500m, $1B?) ensures a material part of best performers are not realized too early

Continuation Vehicles Dynamics:

Provide LP flexibility: Continuation vehicles offer LPs the choice to stay invested or realize (some) gains, catering to different liquidity needs and investment horizons.

Ensure alignment of interests: By maintaining their stake, managers demonstrate confidence in the investment, aligning their interests with those of the LPs and ensuring trust and commitment to the investment’s long-term potential

Single-asset vehicles typically provide better alignment

Lessons from Past Experiences

Navigating Failures and Missed Opportunities:

Learning from missed secondary opportunities: A missed chance to sell a portion of an investment at a reasonable valuation that later failed emphasizes the importance of balancing optimism with pragmatism.

IPO Strategies:

Very few companies become IPO candidates. 1-2 IPOs per fund is a great outcome

Small IPOs don’t work. Sub $2B EV listings rarely produce positive outcomes

Manage lock-in periods and market conditions: Post-IPO, managing lock-in periods and market conditions is crucial for optimizing liquidity and returns. An IPO does not equal liquidity at will. A bit of an art most VCs are not good at

Assess business potential for annual growth: If the business does not show potential to [double] in value annually, consider realizing sooner. VCs are not there to be long term public market investors.

Navigate post-IPO liquidity: Significant stakes often need to be brokered rather than sold openly, requiring strategic partnerships and negotiations to maximize value. Also consider ‘distribution in kind’ appetite of the LPs - many are happy to maintain exposure to long term slower, via a different part of their strategy

Building a Robust Fund Strategy

Sector-Specific Focus:

Specialize in a sector [like deep tech and frontier tech]: Deep expertise in specific sectors allows for more informed investment decisions, and better value-add, leading to higher potential returns. Generally more popular with LPs for early stage funds

Identify high-return potential: Focusing on specialized sectors helps identify investments with ‘deliverable’ outsized return potential that might be overlooked by generalist funds.

Balancing Diversification and Specialization:

Maintain some diversification across narrow themes: Diversifying investments across different themes mitigates correlated risks, ensuring portfolio resilience.

Leverage different revenue/growth cycles: Combining investments with varied growth timelines and revenue models balances the portfolio, optimizing both short-term and long-term returns.

Temporal diversification: investment period of eg 3 years rather than 1 reduces the chance of exposure to temporal hike in valuations

Combine deep tech with B2B software investments: Mixing longer-gestation deep tech investments with quicker-to-revenue software investments is another way to create a balanced and robust investment strategy.

Conclusion

Strategic Exits and Long-Term Patience:

Balance ‘strategic’ tech-driven exits with long-term bets on outlier outcomes to maximize returns.

Learn from past fund performances and refine future strategies for continuous improvement.

Alignment and Sector Expertise:

Align with LPs’ interests through strategic incentives & co-investments and focus on sectors where the fund has deep expertise.

Leverage secondary liquidity opportunities and continuation vehicles for flexible, optimal outcomes, ensuring alignment and trust with LPs.

Specialized yet Diversified Approach:

Maintain a focus on several core investment themes with in-depth sector knowledge to navigate the complexities of venture investments, balance risk and achieve robust, high-return investment portfolios.

👋 Upcoming in-person events we’re hosting

There’s nothing we like better than getting Europe’s best and brightest together with good food, drinks, and conversations that go truly deep.

Fund Modelling Workshop & Mixer | 5th of June | 🌍 Berlin, Germany | Join waitlist.

European VC Awards | 4th of June | 🌍 Berlin, Germany | Get tickets.

📅 Upcoming virtual events

From time to time, a podcast is just not enough. Check out our roundtables and live events below.

🏆 Firesides with the winners of the European VC Awards

Fireside with the Newcomer of the Year Winner | 13/6, 12-1:30 PM | Register here. Hundreds of new VC funds come to market every year. But only ONE will win Newcomer of The Year. This is your chance to meet the winner firsthand.

Fireside chat with the Winner of the Hall of Fame | 25/6, 12-1 PM | Register here.

Hear firsthand from a true giant upon whose shoulders the European tech ecosystem stands tall.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

SuperVenture | 📆 4 - 6 June | 🌍 Berlin, Germany

Nordic LP Forum & TechBBQ | 📆 September | 🌍 Copenhagen, Denmark

How to Web | | 📆 2-3 October | 🌍 Bucharest, Romania

WVC:E Summit 2024 | | 📆 7-8 October | 🌍 Paris, France

North Star & GITEX Global | 📆 14 - 18 Oct | 🌍 Dubai, UAE

Invest in Bravery | 📆 22th of October | 🌍 Kyiv, Ukraine

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany

Firm of The Year Finalist: IQ Capital's Max Bautin on why Deep Tech is on the rise and how to manage the full life cycle of funds