Welcome to a new episode of the EUVC podcast, where our good friends Dan Bowyer and Mads Jensen from SuperSeed cover recent news and movements in the European tech landscape 💬

Have you already met your next fund returner?

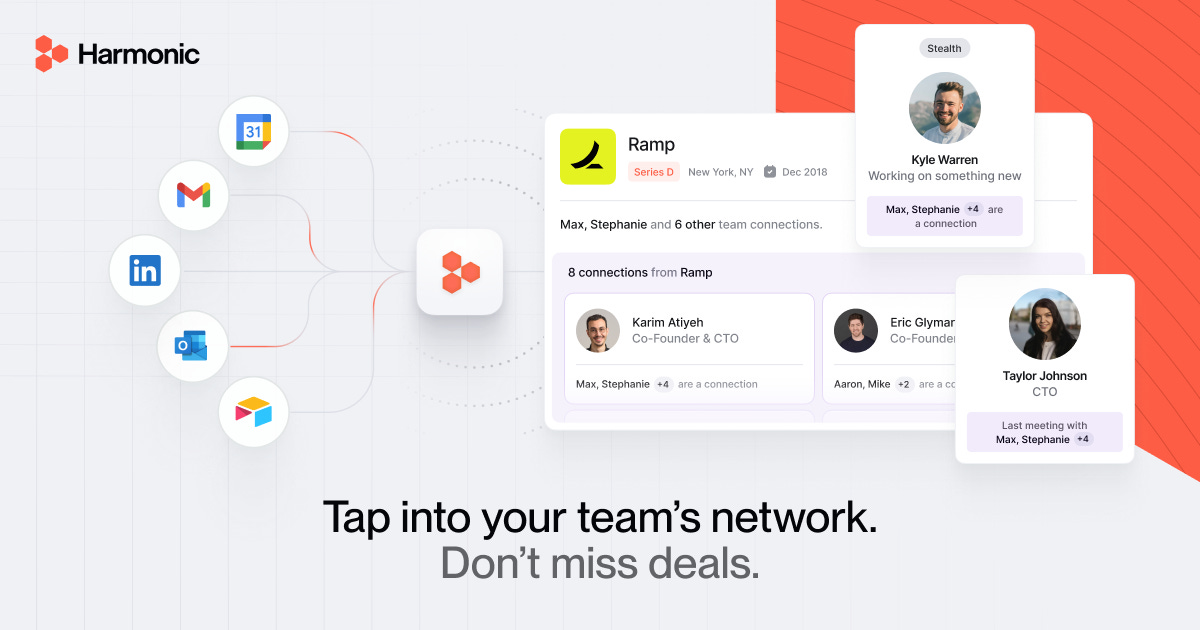

Never miss a network deal, make every intro warm, and know when that founder you spoke to 18 months ago starts seeing traction with Network Mapping in Harmonic.

Harmonic is used by firms like Battery, Greylock, Insight, Menlo, Mosaic, NEA, and over 250 others to find the best startups and founders 6 to 12 months ahead of the competition.

Here are the core take-aways:

AI search start-up Perplexity targets $8bn valuation

Why it matters: For many, Perplexity’s appeal lies in its promise to offer a truly innovative, AI-first search experience, focusing on personalized results and interactive engagement. However, the startup faces an uphill battle against Google, which continues to integrate similar AI capabilities across its vast product ecosystem.

Dan and Mads discussed Perplexity’s journey in a recent podcast, noting that while the startup has a "beautiful product," they see it as a challenge to differentiate significantly from Google. Mads points out that the functionality of Perplexity mirrors much of what Google already offers, making the path to widespread adoption uncertain.

Perplexity CEO Proposes Revenue Deals for Publishers After Lawsuit

Why it matters: As AI search tools like Perplexity leverage vast amounts of online content to power their algorithms, legal and ethical questions around copyright are intensifying. Perplexity’s proposed revenue-sharing model could mark a major shift in the way AI companies and publishers collaborate, potentially setting a precedent for others.

Dan appreciates Perplexity’s bold move but questions if such a revenue-sharing model will be enough to counterbalance its modest revenue and prevent the company from burning through capital too quickly. Despite Srinivas’s strategic partnerships, Dan feels Perplexity’s vision may be “quite small” for the hefty $8 billion valuation, but he admits there may still be "juice to be had" in the niche they’re carving out.

Mads is wary of the broader implications of this model, suggesting that while innovative, Perplexity’s approach might struggle against tech giants that can achieve the same results without partnering up.

Can Anthropic’s New AI really be trusted to control your PC?

What it is: Anthropic’s latest AI model, Claude 3.5 Sonnet, has upped the game in robotic process automation (RPA).

Why it matters: Claude 3.5 Sonnet’s capabilities signal a powerful leap forward for RPA, pushing it from static automation scripts to AI-driven agents that respond dynamically within software environments.

Dan sees the potential in Claude 3.5 Sonnet’s features but is wary of the practical security issues that could arise. For Dan, the move feels reactive, possibly aimed at countering other tech companies (like Salesforce’s “AgentForce”) rolling out similar AI-enhanced tools. While impressed by the model’s evolution, he remains uncertain about its value as a “supremely useful” solution just yet.

Mads describes Claude 3.5 Sonnet as the “next gen” in RPA but cautions that it will likely be a tough sell for enterprises concerned about security. With its blend of RPA and a language model (LLM), Mads calls it a natural evolution for AI, but he stresses that this model will need to overcome significant trust barriers. Anthropic’s efforts to monitor and restrict the agent’s access are essential, he adds, if it’s to be seen as a viable enterprise tool.

NHS app to host patient records - Palantir is running the show.

Why it matters: The NHS app’s patient record system could make significant strides in healthcare efficiency, from reducing paperwork to improving cross-departmental coordination. Supporters argue this move will allow NHS staff, patients, and researchers to streamline access to essential information, saving time and improving care coordination. However, this shift is also stirring concerns around data privacy, with critics questioning the potential for breaches and privacy issues under foreign management.

Dan finds it surprising and somewhat disappointing that the NHS isn’t tapping local talent for such a vital project, given that it might be an opportunity to foster home-grown solutions. Reflecting on the NHS’s history with top-down tech implementations, Dan sees this as a missed chance for smaller firms to contribute to the healthcare ecosystem, potentially leading to more adaptable and secure digital solutions.

Mads, too, is skeptical but intrigued. He points out the NHS’s notorious reliance on outdated technology (yes, the fax machine is still in play), noting that relying on a massive player like Palantir might bring short-term wins but could complicate long-term digital transformation. He sees this as a strategic shift in the right direction for efficiency but remains cautious about privacy implications.

Why Stripe, HubSpot and JP Morgan are buying media companies?

What it is: A recent report by CB Insights reveals a trend: tech and financial services companies are snapping up media and community-focused businesses.

Why it matters: By purchasing media companies, giants like JP Morgan, Stripe, and HubSpot aim to reduce customer acquisition costs (CAC) while enhancing customer lifetime value (LTV) through long-term engagement. The report highlights how this “LTV/CAC arbitrage” lets companies invest in high-value customer relationships by leveraging lower-cost media properties. A prime example is JP Morgan’s acquisition of The Infatuation, a move designed to deepen brand engagement and expand their customer base in a natural, value-driven way.

Mads noted that we’re already seeing “next-gen businesses as content businesses,” where companies leverage media to connect with audiences through valuable content rather than ads alone. He sees this as a powerful way to acquire customers, especially when paired with community-driven engagement.

Dan finds the media acquisition trend savvy, especially as “brands are now trying to become communities.” He pointed out that by buying into audiences directly, these companies avoid the uncertainty of algorithms and social media platforms, retaining control over customer relationships and engagement. He’s curious to see how far this trend will go, especially for smaller companies that might not have the means to acquire but could benefit from this community-driven approach.

How long can we sustain economic growth?

Why it matters: First, he challenges the common belief that resource scarcity will be a limiting factor, arguing instead that technological progress will make us increasingly efficient in our resource use. More intriguingly, Smith references economist Chad Jones’s perspective that a decline in population growth—and therefore fewer researchers and fewer new ideas—might slow innovation, potentially capping economic growth. However, Smith proposes that artificial intelligence could fill this gap by accelerating discovery and acting as a substitute for human researchers, suggesting that AI might be the key to sustaining growth in the future.

Dan is hopeful that AI can offset potential productivity slowdowns, especially as it integrates into research and development sectors. However, he’s cautious, noting that while AI’s potential is enormous, the technology is still evolving and hasn’t yet proven itself as a robust alternative to human-led innovation across all fields. He remains open to AI’s role in driving growth but emphasizes a balanced perspective, especially as industries adapt to these new tools.

Mads views Smith’s argument as a refreshing take, particularly in its optimism around resource efficiency. He sees AI’s potential to scale innovation as significant, especially in areas like biotech and clean energy, where accelerating discovery is crucial. However, he agrees with Smith that slowing population growth could still present challenges. While he’s optimistic, Mads questions whether AI will be able to replicate the diverse insights of a large human workforce and whether this reliance on tech-driven growth is sustainable long-term.

Can AI truly transform the world for the better?

What it is: In Machines of Loving Grace, Dario Amodei, CEO of Anthropic, presents an optimistic vision for AI’s role in shaping a better future.

Why it matters: The essay outlines how advanced AI could make groundbreaking strides in five key areas: physical and mental health, economic development, governance, and work. According to Amodei, AI has the potential to revolutionize human life—from eradicating diseases and alleviating poverty to fostering a new era of liberal democracy and redefining meaningful work. While acknowledging the risks of AI, Amodei emphasizes the importance of envisioning a positive AI future to inspire constructive action rather than fear-driven hesitancy.

Mads finds Amodei’s holistic view refreshing, especially as it addresses not only technical but societal applications, such as promoting mental health and reducing economic disparity. Dan, however, is more cautious, suggesting that while Amodei’s aspirations are compelling, they require rigorous oversight and realistic expectations about AI’s limitations.

Can Europe close its innovation gap with the US?

What it is: A recent analysis highlights Europe’s struggle to catch up with the US in tech-driven innovation.

Why it matters: While the US economy thrives on high-tech sectors and massive private investments, Europe remains largely tied to traditional industries and hampered by fragmented policies. The author suggests that Europe’s lag isn’t just a funding issue but one of structure and strategy. Rather than increasing public R&D subsidies, they propose smarter procurement policies, simplified startup regulations, and even the development of a “programmable digital euro” to foster a larger, more integrated market for software and tech startups.

Mads pointed out that Europe’s reliance on legacy sectors, such as automotive, leaves it vulnerable as global demand shifts toward digital-first industries. He believes Europe’s best bet is to enable more robust private sector innovation by supporting policies that help startups scale and keep talent within Europe.

Dan agrees with the need for a strategic overhaul but questions the practicality of implementing a unified approach across Europe. While he sees the potential of a digital euro as a unifying tool, he points out that Europe’s regulatory landscape remains complex, and the slow pace of policy reform could hinder meaningful progress. He’s hopeful but thinks Europe will need to push aggressively on digital-friendly reforms if it wants to stay competitive.

Why is Europe’s tech sector falling behind the US?

Why it matters: Since 1995, US productivity has doubled, while Europe’s has only grown by 30%. According to Weldon, former ECB head Mario Draghi attributes much of this disparity to Europe’s underperforming tech industry. Europe’s tech and productivity challenges have significant implications for its economic future and its global competitiveness.

Mads pointed out that Europe’s heavy regulations discourage startups and stifle the growth of tech firms that could drive economic expansion. He sees the bureaucratic hurdles as not only delaying innovation but also causing companies to relocate to more business-friendly environments like the US.

Dan agrees with the need for regulatory reform and thinks simplifying Europe’s competition policies could help the region attract and retain tech talent. He’s concerned, however, that Europe’s regulatory processes are notoriously slow to adapt, which could make it challenging to implement the swift changes needed to close the gap with the US. Dan also noted that the cost of energy in Europe, another competitive disadvantage, further complicates matters.

A decade of big S&P 500 gains is over

Why it matters: Goldman Sachs forecast a lower nominal return of around 3% per year over the next ten years, a shift driven by a potential pivot to alternative assets like bonds, where returns may be higher. Goldman estimates a 72% chance that the S&P 500 will underperform Treasury bonds in the coming decade. Despite this outlook, Goldman suggests that recent S&P 500 rallies may still continue, albeit with more moderate, sector-specific gains.

Mads noted that Europe could capitalize on the potential U.S. slowdown by strengthening its own tech and industrial sectors. He stressed that Europe’s competitive advantage will depend on addressing regulatory constraints and focusing on digital-forward industries. To truly benefit from any U.S. downturn, Mads believes Europe needs to foster a tech ecosystem capable of capturing global investor interest.

Dan, meanwhile, agreed that Europe could benefit from such a shift but highlighted the region's challenges, including high energy costs and slow regulatory adaptation. He argued that easing regulatory constraints could make Europe more attractive to investors as the S&P cools, but warned that Europe’s slow pace of reform could limit its ability to act quickly enough to capitalize on these opportunities.

How much damage can Trump really do to the U.S. economy?

What it is: Noah Smith’s recent article in Noahpinion examines the potential economic impact of Donald Trump’s policies if he were to return to the presidency.

Why it matters: Smith warns that Trump’s policies, while they might appear economically beneficial in the short term, could have long-term negative impacts on the U.S. economy, particularly by weakening the Fed’s ability to control inflation.

Smith focuses on three primary areas: mass deportation, tariffs, and tax cuts aimed at the wealthy. While the first two policies could have more moderate impacts, Smith argues that Trump’s proposed tax cuts are particularly concerning due to their potential to significantly inflate the national debt. The most serious risk, Smith suggests, is inflation, especially if Trump were to pressure the Federal Reserve to lower interest rates to fund his spending.

Mads highlighted that Trump’s anti-immigration stance and restrictive trade policies could drive up labor costs and fuel inflation by tightening the labor market and increasing production costs. He expressed concern that Trump’s tax cuts, which would largely benefit the wealthy, could increase the national deficit, triggering inflationary pressures that would likely lead to rising interest rates. Mads believes these factors could strain not just the U.S. economy but also impact global markets, making it crucial for Europe to strengthen its economic foundations to handle any potential shockwaves.

Dan shared these concerns, adding that Trump’s unpredictability and focus on short-term gains could lead to hasty policies with far-reaching consequences. He noted that Europe, which often follows U.S. economic trends, might face challenges adapting to any destabilization in U.S. markets. Dan suggests that while Europe could benefit from a more stable economic environment than the U.S., it must stay vigilant and prepared for any economic disruptions that might spill over from a Trump-led U.S. administration.

Share your insights to Atomico’s State of European Tech 2024 report.

It takes just 5-7 minutes to complete, and by doing so, you’ll also enter for a chance to win some fantastic prizes, including tickets to Slush, the world’s biggest and most founder-focused VC event.

Your voice can help shape the most complete snapshot of European tech yet!

Be part of it!

🤗 Join the EUVC Community

Looking for niche, high-quality experiences that prioritize depth over breadth? Consider joining our community focused on delivering content tailored to the experienced VC. Here’s what you can look forward to as a member:

Exclusive Access & Discounts: Priority access to masterclasses with leading GPs & LPs, available on a first-come, first-served basis.

On-Demand Content: A platform with sessions you can access anytime, anywhere complete with presentations, templates and other resources.

Interactive AMAs: Engage directly with top GPs and LPs in exclusive small group sessions — entirely free for community members.

🧠 Upcoming EUVC masterclasses

Advanced small-group sessions that take you from good to great. Lectured by leading GPs, LPs & Experts.

EUVC Masterclass: Marketing & VC Fund Narrative

Your brand is everything. It’s what sets you apart, helps you win the best deals, attract LPs, and ultimately drive your growth. For emerging fund managers, building a credible brand and establishing the right marketing foundations early on are game-changers. Yet, many don’t know where to begin.

Your fund’s narrative is what makes the difference between an LP glancing at your deck or deciding they’re ready to write a check. It’s your brand that makes LPs feel confident they’re partnering with someone who knows how to make magic happen.

We’re planning a masterclass on building strong marketing foundations with a top industry leader. If enough people show interest, we’ll make it happen.

EUVC Masterclass: Benchmarketing for GPs & LPs

In venture, knowledge is power—and benchmarking is the key to unlocking it. Understanding where you stand against your peers is what makes you set realistic expectations, and drive portfolio performance.

For GPs, benchmarking can reveal the strengths and weaknesses of your portfolio, while for LPs, it provides a clearer picture of where your commitments stand in the broader market. Yet, many don't know how to effectively utilize benchmarking tools or interpret the data.

We’re planning a masterclass on mastering the art of benchmarking, led by a top expert in the industry. If enough people express interest, we’ll make it happen!

Got ideas or requests for future topics to cover? Let us know here.

🗓️ The VC Conferences You Can’t Miss

There are some events that just have to be on the calendar. Here’s our list, hit us up if you’re going, we’d love to meet!

0100 Conference Mediterranean | 📆 28 - 30 October | Milano, Italy

culttech summit | 📆 5-6 November | Vienna, Austria

GoWest | 📆 28 - 30 January 2025 | 🌍 Gothenburg, Sweden

GITEX Europe 2025 | 📆 23 - 25 May 2025 | 🌍 Berlin, Germany

Perplexity’s $8B Target, Anthropic’s AI Control, NHS Data Privatization, and Tech Giants’ Media Acquisitions – with Dan Bowyer